Welcome to this week's Startup Investments Insider from CrowdInvest.

Key Highlights:

This week’s Startup Investments Insider takes a look at the benefits that NFTs bring to trading #alternativeinvestments, including equity in startups, and then closes with a roundup of other recent fintech media coverage.

Benefits NFTs bring to Alternative Investments

Ownership of company shares and property will be among the many things that will exist as non-fungible tokens in the future. NFTs bring several benefits to alternative investments for non-professional investors, particularly in startup equity. NFTs can also be used as proof of ownership of more tangible assets, with each unique NFT representing a fraction of an assets’ overall ownership. Other benefits include liquidity, more accessible cross-border investing, security, and exclusive “extras.”

Recent fintech news included the UK Treasury Committee’s recommendation that cryptocurrency, the most common way to trade NFTs, should be regulated as a form of gambling, with stricter rules to “protect unwary consumers.” This is highly inconsistent with Rishi Sunak’s previous support for the fintech sector which included plans to make the UK a “global hub for crypto.”

At the same time as blockchain-based crypto fell further out of favour with the UK "financial establishment," more enterprises are finding out for themselves the benefits offered by blockchain-based #NFTs, which are most commonly traded in crypto. Major B2C brands including Adidas, Renault and Stella Artois lager have successfully used NFTs to engage with key audiences and enhance their branding.

1. Fractional Ownership

NFTs allow for fractional ownership of assets such as a piece of artwork, luxury items, real estate property, or equity in a startup. This opens up investment opportunities that may have been previously inaccessible to non-professional investors due to high minimum investment levels.

A selection of platforms offering fractional ownership of assets, and which are likely to introduce NFTs if they haven’t already, include these four:

- The UK’s Maecenas platform allows investors to buy and sell fractional shares of fine art. Multimillion-dollar artworks are tokenised into "asset tokens". Each asset token represents a share of the beneficial interest in the underlying artwork and can be traded instantly on a global exchange. All asset tokens representing a share of an artwork are secure blockchain tokens, compliant with the Ethereum ERC20 standard.

- US platform Fractional allows users to invest in high-value assets by fractionalising them into ERC-20 tokens, represented as NFTs on the Ethereum blockchain. Users can buy and trade these NFTs, enabling them to own portions of high-end artwork, collectibles, luxury goods, and other assets.

- The Wine Cask platform in France focuses on fractionalised ownership of fine wines through tokenising individual wine bottles and collections. It allows investors to own a portion of these assets as NFTs.

- European real estate investment platforms that utilise blockchain and NFTs to enable fractional ownership include BrickMark Group in Switzerland.

2. Liquidity

NFTs provide liquidity to traditionally illiquid assets like equity in privately-owned startups. Startups and early-stage companies may take several years to reach an exit. NFTs enable investors to trade their ownership stakes in companies on secondary markets, allowing them to realise a personal exit earlier than a date decided by the business they invested in.

3. Increased Accessibility

Retail investors often face barriers to participating in traditional equity crowdfunding due to geographical limitations or regulatory restrictions. NFTs, being based on blockchain technology, offer a decentralised and cross-border investment environment. This means that investors from anywhere in the world will be able to participate in equity crowdfunding campaigns (subject to the regulations applicable to each crowdfunding platform), expanding the potential investor base and providing greater access to investment opportunities.

4. Transparency and Security

Blockchain technology provides transparency and immutability to NFT transactions because every transaction related to an NFT is recorded on the blockchain. This level of transparency helps mitigate fraud and ensures that investors can verify the authenticity and provenance of the assets they are investing in. Additionally, the use of blockchain technology enhances the security of NFT transactions, reducing the risk of unauthorized changes or tampering.

5. Enhanced Investor Engagement

Retail investors holding NFTs may gain access to exclusive perks, benefits, or experiences associated with the underlying asset or the crowdfunding campaign. This can include VIP access to events, early access to new product releases, special voting rights within the company, access to restricted content, or discounts on purchases.

If equity acquired in a business through #equitycrowdfunding is not provided as an NFT, other NFTs could still be offered as an incentive to potential investors.

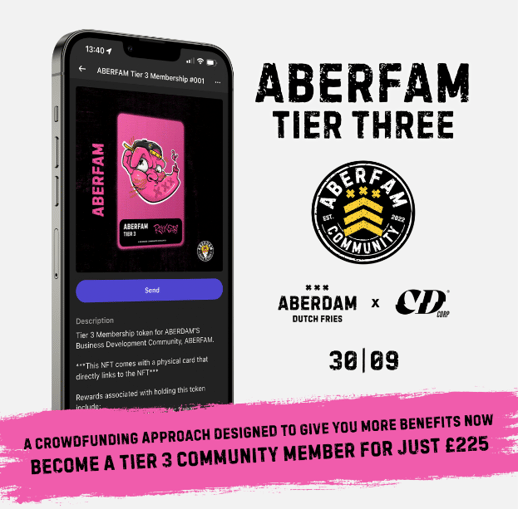

Image source: CDCORP, Aberdam's Digital Media Services provider

Scottish fast food startup Aberdam was the first UK small business to offer crowdfunding investors Aberfam NFTs as a perk. They made 820 founder memberships available in three price tiers, and each one included an official NFT based on an individual, original piece of artwork. NFT owners also qualify for automatic savings on all food and drink orders. Such added benefits can encourage retail investors to participate in a crowdfunding project.

Beware….

It's important to note that while NFTs offer these potential benefits, they also come with risks. The NFT market is relatively new and still evolving, and it's important for retail investors to thoroughly research and understand the projects they are investing in, as well as the potential risks associated with NFTs and equity crowdfunding in general.

Now Let's Review Recent Updates in Alternative Finance

Cross-border finance

- Tech.eu’s annual summit in Brussels this week will include funding pitches from 20 tech startups, with four from the UK including the London-based Homevest. It helps property buyers find cross-border mortgages. The Tech.eu summit will be streamed online on May 24.

NFTs

- Adidas’s Web3 lead thought she ‘could get fired’ for signing an NFT deal with Bored Ape Yacht Club. It went on to raise $23 million, and will continue to earn further income from smart contract secondary market royalties.

Crypto

- A number of UK crypto bosses slammed the UK Treasury Committee’s recommendation to regulate crypto trading as gambling, and introduce stronger measures to “protect consumers.” Comments included in the report such as "no intrinsic value, huge price volatility and no discernible social good" and "a zero-sum outcome and mainly benefitting scammers" hardly sound objective or impartial.

- As those crypto bosses were complaining the link with gambling was unfair, it was with some irony that we spotted UK-based ALOPDALE has launched what they describe as an innovative crowdfunding-based platform, in 16 countries, for people to earn crypto while playing roulette.

Equity fundraising

- EIS (the Enterprise Investment Scheme) is the UK Government’s flagship tax incentive to encourage private individuals to invest in fast-growing UK businesses. The rise in the recorded number of SMEs (small and medium enterprises|) looking to raise funds through #EIS shows that enthusiasm for equity-based fundraising among small businesses is growing, reported City AM.

Jobmate CEO Christopher Dalton. Image source: LinkedIn

- Wolverhampton-based Jobmate is one of them. It aims to provide sole traders and micro businesses with automated workflow software and an app to help them run their businesses. Its new round of equity crowdfunding is raising funds to accelerate growth, with a £250,000 target. EIS benefits are available to investors. By May 19 it was 29% of the way to its target with 18 days remaining.

Sustainability

- A survey by the financial services company Charles Schwab among 1,000 UK investors found that the number considering #ESG when making new investments has fallen from 44% to 38% since 2021. The number of investors prioritising sustainable investing over maximising returns fell from 55% to 47%, reported Investment Week.

The Japan Times reported that sustainability tech platform Clarity AI, whose clients include BlackRock, Invesco and MetLife, found just 4% of funds with some version of the word "sustainability" in their names comply with all current and future planned requirements set by each of the relevant authorities in the UK, US and EU. Sounds like some consistency would be beneficial.

Have you enjoyed the read? Make sure you are subscribed to the Startup Investments Insider! New content is published each week.

What is CrowdInvest? CrowdInvest is a cross-border platform offering UK-based sophisticated investors opportunities to invest in impact-driven, high-growth tech startups operating in emerging economies. It is currently facilitating the UK-India corridor while holding the vision to go global.

How can I access CrowdInvest's offerings as an Investor? Join our waitlist now to be among the selected few who will receive an exclusive invitation to our platform's Alpha version. As an Alpha user, you can invite your selected network and earn referral bonuses of up to £100 each to invest in pre-vetted deals through the platform.

To learn more about CrowdInvest, visit,

Website | Twitter | Join Waitlist and secure your spot among the elite investors